Comparison: What can be achieved by local government

21st July 2020

Housing, development and the future: ‘Providing quality homes for those in housing need’

21st July 2020A decade in review

The 2010s were something of a lost decade for housing in Ireland. The recession and the austere recovery from it saw the housing market’s complexion completely change, while record numbers for homelessness, house prices and rents were all recorded.

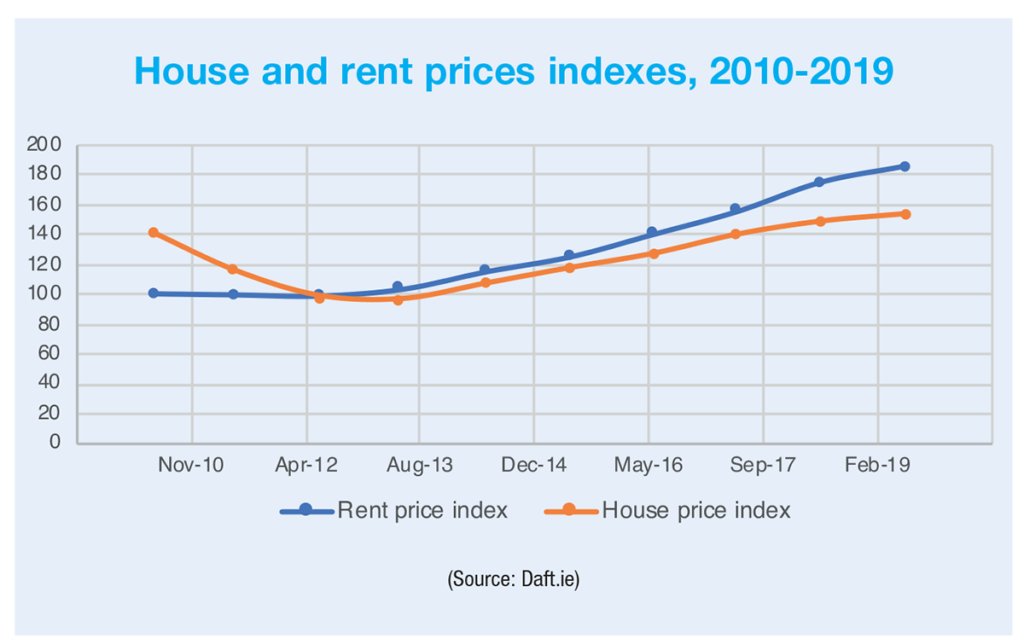

Rent prices

“Still a renter’s market, as supply outpaces demand”; the headline accompanying Daft.ie’s rental price report for quarter one of 2010 can feel like reading about a different world when the decade that followed is taken into account. By Q1 2010, the large rent falls of 2009 (at least 4 per cent per quarter) had tapered off, but rents still fell 0.4 per cent year-on-year for the quarter, bringing the average nationwide rent to just under €760 per month.

As these falls eased, rent levels were roughly 25 per cent below their peak in 2007. The number of properties available to rent at any time was also reported to be increasing. By the time of Daft’s last rental price report for the decade, the first quarterly decrease in over seven years was being reported. Q4 2019 rents fell 0.1 per cent from the previous quarter, leaving the nationwide average rent at €1,402, almost double that of the average at the beginning of the decade. This was the first quarterly fall recorded since April 2012, 30 quarters previous.

However, while the average fell, rents continued to rise in urban areas, such as Dublin (0.4 per cent), Cork (1 per cent) and Galway (0.8 per cent). Availability had begun to improve in 2019, with all but one month showing an increase of the numbers of properties available to rent.

The decade was one of unprecedented growth in rental prices as monthly increases were recorded every month from November 2014 to June 2019, except for December 2016, when the index remained static from the previous month. Record rents were consistently set during this time, peaking in Q3 2019 with a quarterly average rent of €1,403 per month, almost double the decade’s low in Q4 2011.

Rent prices in Dublin doubled in the decade, with South County Dublin ending the decade with an average rental price of €2,227.

House prices

The decade in house process was much like the decade of rental prices in that it began with prices rapidly falling and ended with a slight comedown from the significant inflation that had occurred over the course of the decade. The Daft house price report records 2010 Q1’s average national sale price at just above €234,000, 17.4 per cent lower than it had been in Q1 of 2009. This fall made it one of 16 consecutive quarters where double figure percentage drops year-on-year occurred around this time. It was also the 10th in a line of 24 consecutive quarters where prices fell.

The next 24 quarters – from 2013 to 2019 – saw year-on-year rises in every quarter. Prices hit their peak for the decade in early 2019, with Q1 recording an average list price of €261,000 and then Q2 increasing to €263,000. A slight decrease occurred in the second half of the year, first to an average of €257,000 in Q3 and to €251,000 in Q4, still some €16,000 on average higher than the decade’s starting point.

December 2019’s average list price was some 52.8 per cent higher than the decade’s lowest monthly average, November 2012. In Daft’s report, the average house price is lower year-on-year for Q4 2019, a first in six years after a fall of 1.2 per cent, although 18 of the 54 markets surveyed were still showing increases.

The CSO’s Residential Property Price Index, which uses June 2015 as its base, records a 21 per cent rise in national average house price from January 2010 to December 2019. The index peaks in October 2019, with a score of 136. The index’s low point for the decade occurred in March 2013, with an index score of 73.4.

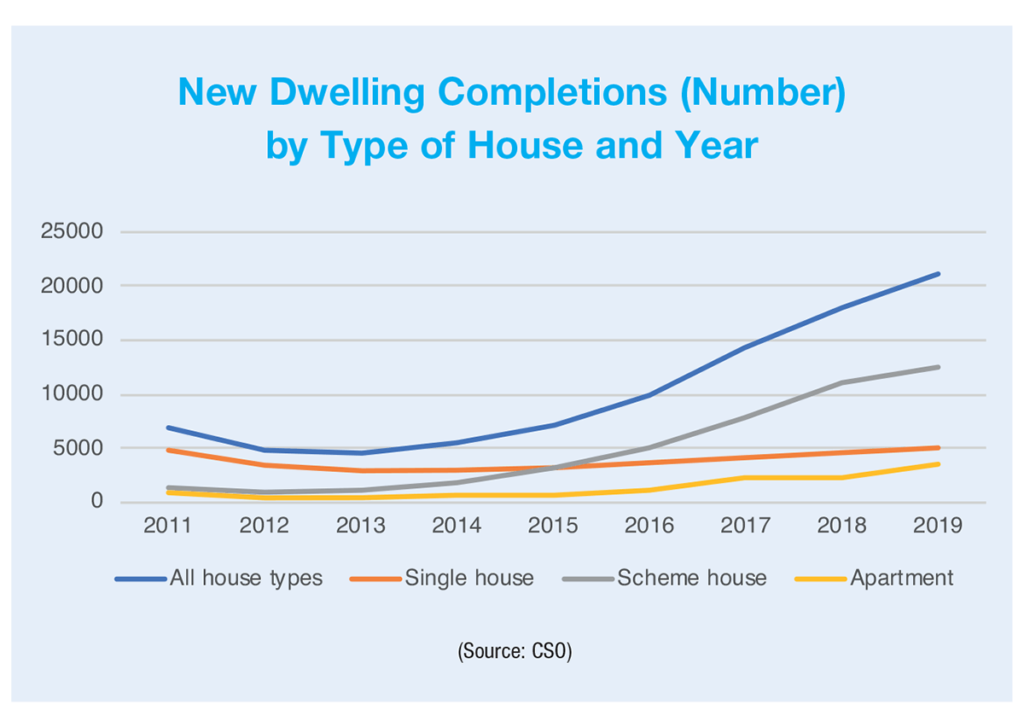

Housing completions

New dwelling completions were a central aspect to arguments regarding Ireland’s housing market as they fell to bare levels and were slow to recover in the first half of the decade. The lack of supply in the market has been largely blamed for the twin crises of skyrocketing rents and ever-increasing homelessness.

CSO data for new dwelling completions begin in 2011, itself an indicator of the lax attitude taken toward the number of houses delivered by previous governments who had entrusted delivery to private construction. The most notable change in dwelling completions during the decade is the role reversal of single houses and scheme houses. With the former starting the decade making up the vast majority of new builds, but with the latter now being built at more than double the rate at the end of the decade.

In 2011, only 6,994 new dwellings were completed; 4,814 of those were single homes, with only 1,358 scheme homes. By 2019, the overall number had increased to 21,138; 5,065 of these being single house and 12,521 being scheme houses. Apartments have also seen a major uptick in the second half of the decade. Having completed only 822 in 2011, this figure fell below 500 for the years 2012 and 2013 and stayed below four figures until 2016. By 2019, 3,552 were completed within the year.

The nadir for completions came in the years 2012-2014 when each year recorded a number of completions lower than 2011, the lowest being just 4,575 in 2013. Even as things began to improve in the mid-decade, five-digit figures (i.e. over 10,000 completions) were only recorded in the last three years of the decade.

The uptick has been partly due to Rebuilding Ireland, the Fine Gael minority government’s plan to boost construction of home dwellings in Ireland, but industry analysis says that Ireland is still failing to meet the demand within the country. The Central Bank has estimated that the country should be building 32,000 homes per year in order to meet demand, almost 11,000 more than were completed in 2019.

The Rebuilding Ireland progress report for Q2 2019 claimed that the government had delivered 84,147 homes since the launch of the plan in 2016. However, 60,379 of those have come through the private rental market, the vast majority through the Housing Assistance Payment, the rest through the Rent Accommodation Scheme, meaning that new builds – specifically the affordable and social housing so badly needed in Ireland – are still to be delivered to the required level.