The affordability question: Cost rental and the affordable purchase schemes

4th July 2022

Respond: Committed to providing future-proofed and cost efficient homes

4th July 2022Costs, capacity, and production: The challenges facing construction

As costs in construction materials continue to inflate, a survey has found that 91 per cent of construction companies expect further rises in Q2 2022, and that 89 per cent are unwilling to take on fixed-price contracts as a result.

Costs

The Construction Outlook Survey, undertaken by the Construction Industry Federation in April 2022, found that rising costs of materials and expected further rises throughout 2022 means that construction companies are unlikely to take on fixed-price contracts, which are used by government for projects such as the building of social housing. The key challenges identified within the survey by companies were the cost of raw materials (88 per cent), access to skilled labour (72 per cent), and fuel (68 per cent).

91 per cent of companies were found to believe that the economic sanctions arising from the Russian invasion of Ukraine will lead to further cost increases, with 85 per cent believing that the price of construction projects themselves will rise concurrently. 82 per cent say that the war in Ukraine has already disrupted supply chains in the sector, with 98 per cent reporting an increase in raw material costs in the three months previous to April 2022.

In response to these issues, 89 per cent of respondent companies said that they want the Government to introduce an “effective and fair price variation clause into public sector contracts, which would apply retrospectively”. The survey also found that 38 per cent of construction companies saw their turnover increase in Q1 2022, with 39 per cent expecting an increase in Q2. 32 per cent of companies also expected to grow their employment levels in Q2, while 75 per cent believe that the sector would benefit from attracting more women to work in the industry.

The Central Statistics Office (CSO) collates data on detailed wholesale prices for building and construction materials as part of its monthly Wholesale Price Index. April 2022’s edition of the index shows a yearly increase in every category included in the building and constructions materials index, the largest of which occur in “other” timber (92.7 per cent), “other” structural steel (71.3 per cent), reinforcing metal (66.5 per cent), and structural steel (42 per cent). The index shows a yearly rise of 18.2 per cent overall in all material from April 2021 to April 2022.

In terms of monthly rises, April 2022 shows a 3.1 per cent price increase in all material, compared to 1 per cent and 0.9 per cent changes in the preceding March and February respectively. The largest rises during the month again occurred in steel and reinforcing metal, with the price of fabricated metal rising 31.4 per cent and the price of structural steel rising by 27.6 per cent. Using 2015 levels as a baseline, the index shows: stone, sand and gravel prices have risen 17.7 per cent; cement prices have risen 44.5 per cent; structural steel and reinforcing metal prices have risen 86 per cent, with “other” structural steel rising 110.5 per cent; rough timber prices have risen 78.4 per cent; electrical fittings prices have risen 25.5 per cent; and bituminous macadam, asphalt, and bituminous emulsions prices have risen 7.8 per cent.

Capacity

Housing for All places importance on the expansion of the capacity of the construction sector, with an estimated need of an additional 67,500 workers in the residential construction sector “by the middle of the decade” if the average yearly delivery of 33,000 homes is to be delivered. The plan states that this will be achieved through the increasing the provision of construction skills, education and training, promoting careers in these areas, and recruiting workers internationally.

Central to this will be the successful implementation of the Action Plan for Apprenticeship 2021-2025, which has a target of delivering 10,000 apprenticeship registrations by 2025. The 2022 Q1 progress report for Housing for All reports that 2021 saw 8,607 apprenticeship registrations, 6,955 of which were “in craft apprenticeships largely in the construction trades (dominated by carpentry, electrical, and plumbing)”.

SOLAS, the state agency for building further education and training, is said within the progress report to be fast tracking reviews of “certain construction trades programmes”; funding has been provided under Springboard and the Human Capital Incentive to incentivise the delivery of programmes that support development in relevant areas; and research on skills gaps up to Level 6 on the National Framework of Qualifications is soon to be finalised.

Production

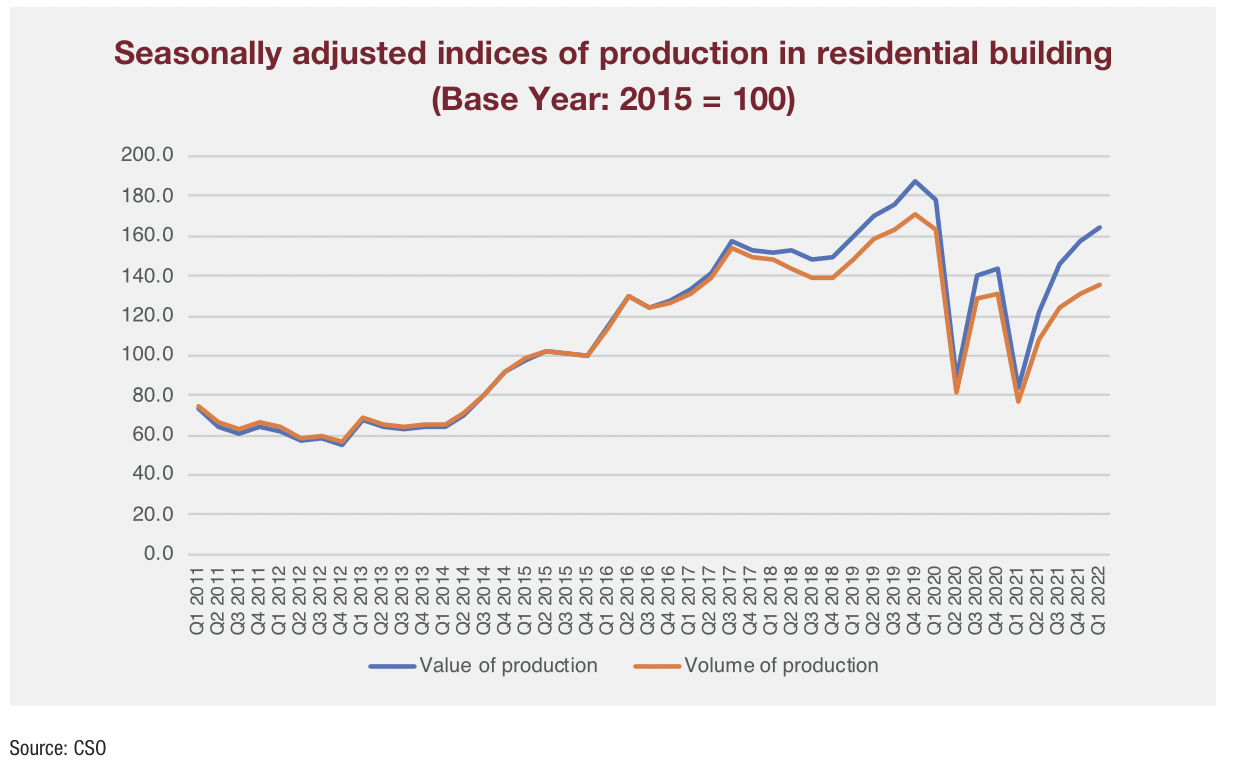

The CSO’s Production in Building and Construction Index for Q1 2022 shows the volume of production in construction in Q1 to have decreased by 2.4 per cent when compared with Q4 2021, rose by 23 per cent when compared with Q1 2021. Activity in the construction sector remains lower than pre-pandemic levels, with Q1 2022 showing a 14.6 per cent decrease in production compared to Q1 2020. These figures perhaps cast doubt on the capacity to deliver the 20.16 per cent increase in new dwelling completions necessary to meet the 2022 Housing for All goal of delivering 24,600 new homes, although not all of these will be new builds and the residential sector did show a quarterly increase of 2.8 per cent.

Activity levels also remain lower than Q1 2020 in the residential, non-residential, and civil categories, with the seasonally adjusted value index for construction falling by 6.8 per cent in the same period.

Civil engineering shows the largest quarterly decrease (11.8 per cent) in the volume index, while the non-residential sector decreased by 1.7 per cent. The value index for construction decreased by 2.2 per cent on a quarterly basis and increased by 36.5 per cent on an annual basis.