Housing for All: Delivering social and cost rental targets

4th July 2022

Croí Cónaithe (Cities): Unlocking apartment development potential

4th July 2022Housing for All: ‘Strong pipeline’ for 2022

Early indicators “suggest a strong pipeline of housing for 2022”, although the construction industry’s capacity to exceed the 20 per cent increase needed to meet Housing for All targets for 2022 remains to be seen.

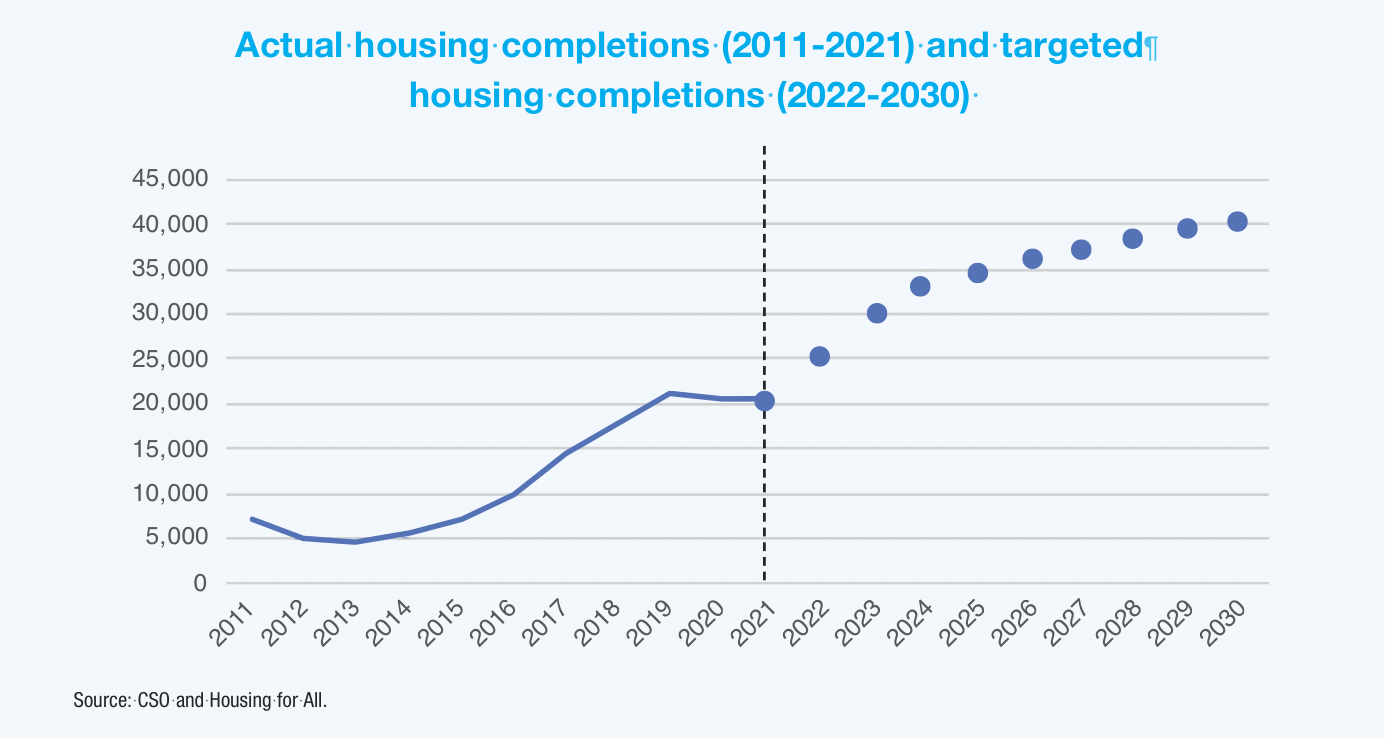

As the first step in achieving Housing for All’s headline target of an average of 33,000 homes per year in the period 2022-2030, 24,600 homes are expected to be delivered in 2022, which would require an increase of 20.16 per cent from 2021, when 20,433 new homes were completed. Such an increase is historically precedented, with yearly increases as high as 45.51 per cent recorded in the 2010s, although questions remain surrounding the construction industry’s capacity to increase further.

2021’s overall figures show a decrease of 41 houses from the year previous and a decrease of 574 from 2019, the last recorded year unaffected by Covid-19 lockdowns. The report also reveals that seven actions due for implementation in Q4 2021 were carried into Q1 2022 to make a total of 20 actions due for the quarter, 12 (60 per cent) of which were successfully implemented. Overall successful implementation for the plan thus far stands at 70 per cent.

New dwelling completions

The completion of 24,600 in 2022 new dwellings is committed to as the beginning of the delivery of 312,750 homes from 2022-2030. To achieve the necessary 20.16 per cent increase, a total of an extra 4,127 homes must be completed. In the decade 2011-2021, total increases in dwelling completions were recorded six times, the largest of which were recorded consecutively in 2017, 2018, and 2019, showing that the Irish construction industry had been on track for the type of delivery envisioned within the plan.

In 2017, a 45.51 per cent increase from 9,842 completions to 14,321 was recorded; this momentum was then carried into 2018, when a 24.98 per cent increase was recorded for a total of 17,899 completions; 2019 then saw an increase of 17.59 per cent and the breaching of the 20,000 mark for completions, with 21,047 new dwellings completed. This means that while the increases in construction numbers needed to reach the targets set out in Housing for All will be difficult to achieve, such an uptick would not be unprecedented. The hope for both government and the construction industry that the decreases recorded since then are simply a case of the long-term effect of the Covid pandemic and its lockdowns rather than the sign of an industry that has reached its capacity ceiling.

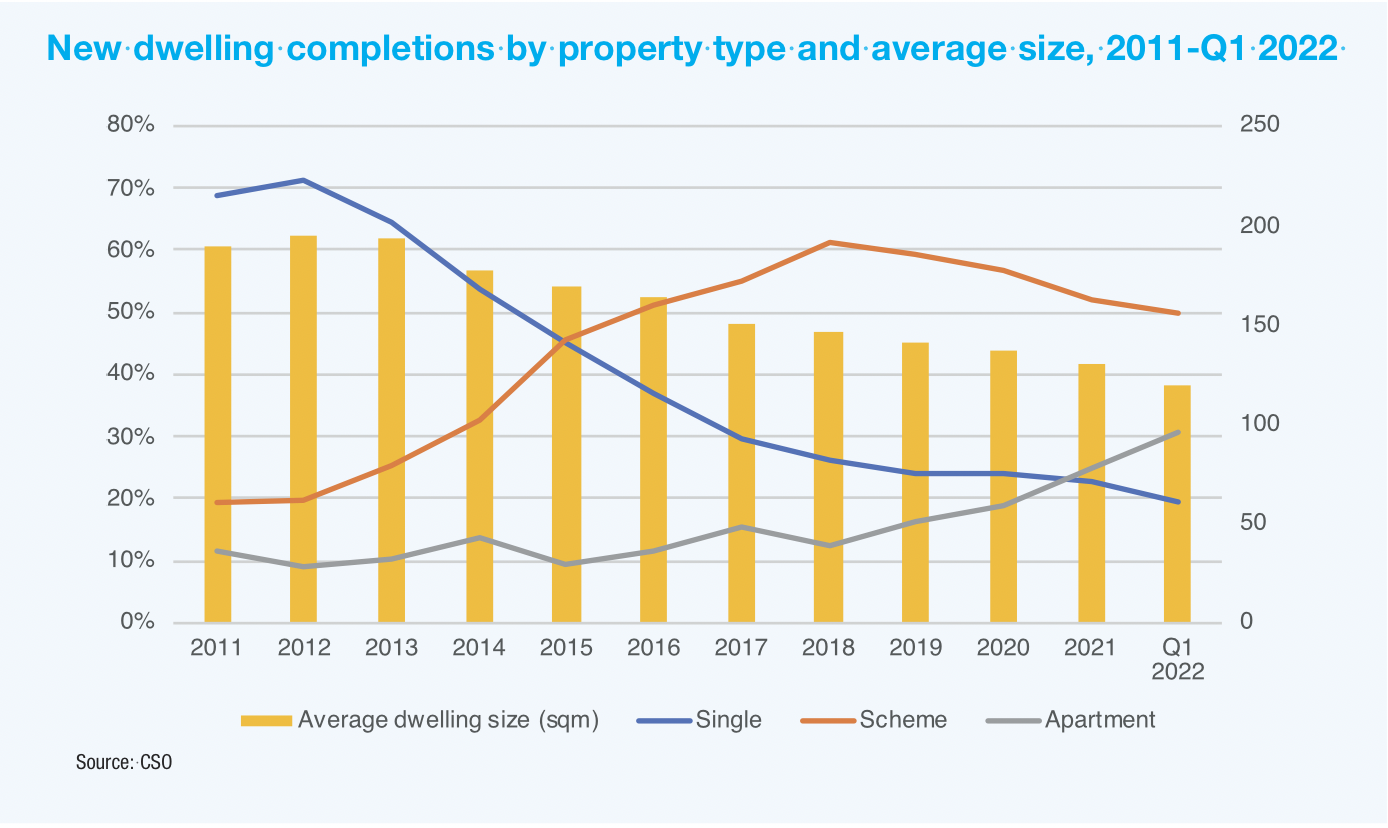

The progress report on the implementation of Housing for All for Q1 2022 issued by the Government shows there to have been commencement notices received for 4,200 new homes in the first two months of 2022; with 42,991 homes granted planning permission and 30,724 new houses commencing construction in 2021, this represents a “strong housing pipeline” for the Government that indicates the realisation of 2022’s targets is possible. Over 60 per cent of the permissions granted in 2021 were for apartments, “which demonstrates an emerging pattern of development which responds to our objective of achieving sustainable, compact growth”.

Central Statistics Office (CSO) research shows there to have been 5,669 new dwellings completed in Q1 2022, a decrease on Q4 2021 (6,975) but an increase on Q1 2021 and substantially bigger than any Q1 in the 2010s. Of the 5,669, 1,742 (30.73 per cent) were apartments, meaning that apartment completions have yet to catch up with the rate of apartment planning permission consents (over 60 per cent). Were completion numbers to keep pace with Q1, the 2022 target of 24,600 completions would be missed by roughly 2,000 homes. However, since 2015 dwelling completion numbers have typically seen a marked increase from the first half of the year to the second half; for example, 4,243 new dwellings were completed in Q1 2019, with 6,368 completed in Q4 of the same year.

Actions

Of the 213 total actions contained within Housing for All, 135 have “now either been completed or are being delivered on an ongoing basis”, including measures to support the capacity of the public and private construction sectors “and to address critical enabling factors, such as the availability of land, access to the required levels of development financing, the timely provision of utilities including water, electricity and broadband and the fundamental reform of the planning process”.

Highlights within these 135 actions as highlighted by the Government include: the opening of the Local Authority Home Loan, with €250 million made available for 2022; the receipt of applications for home to be provided under the Local Authority Affordable Purchase Scheme, under which homes in south Dublin are priced at €245,600, a 20 per cent reduction on market rates; the scaling up of cost rental delivery, with tenants moving into 50 cost rental homes in Dún Laoghaire-Rathdown; the submission of an application for roughly 1,800 homes by the Land Development Agency; the publication of the Town Centre First policy; the finalisation of the Croí Cónaithe Fund; the publication of the National Housing Strategy for Disabled People; the progression of Project Tosaigh; the foundation of the Housing First National office to enable the delivery of 1,319 housing first tenancies by 2026; the delivery of €12 million in funding for the Repair and Lease scheme targeting 120 homes in 2022; and the launch of the National Home Energy Upgrade Scheme.

Cost rental units delivered

Social and affordable housing

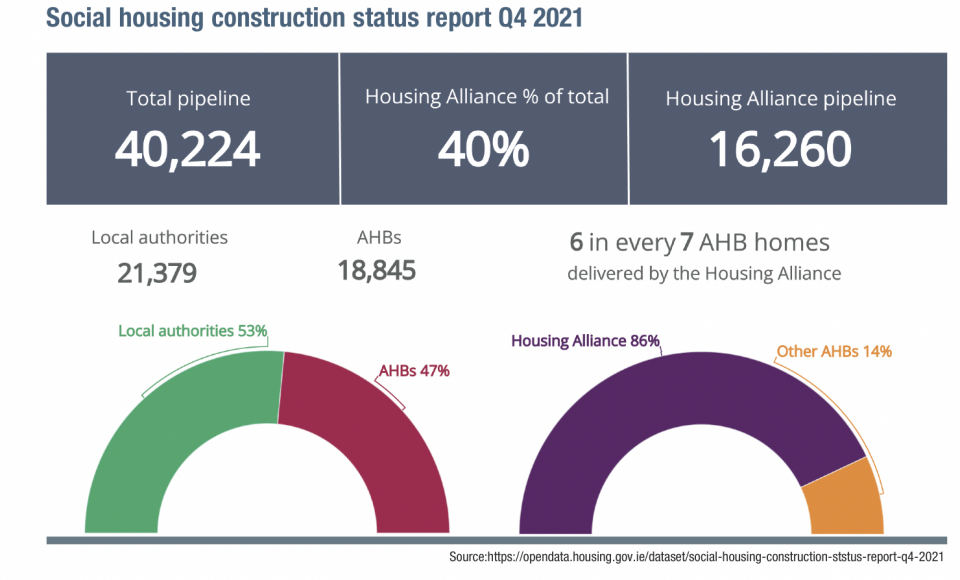

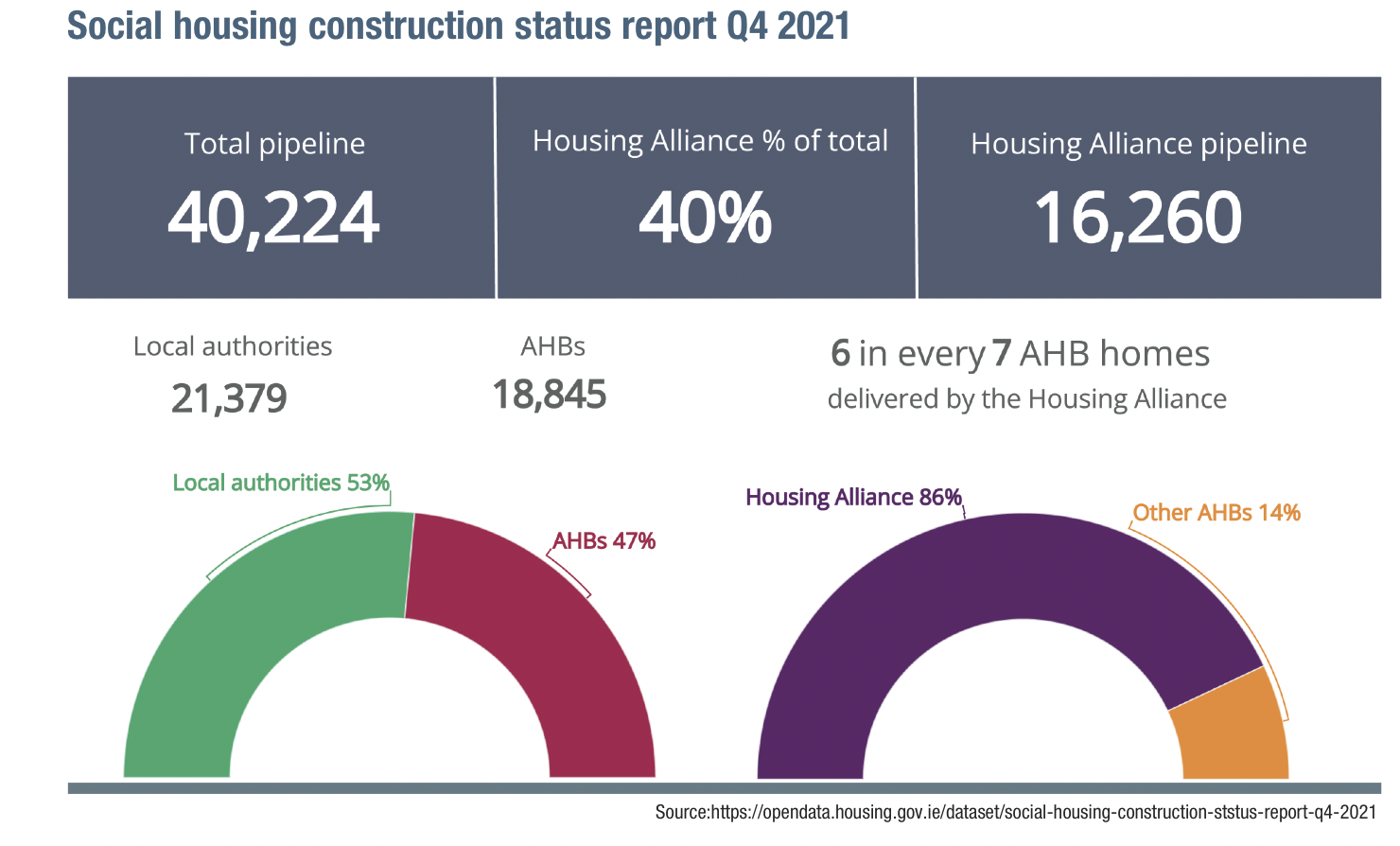

Including in the delivery target of 24,600 homes in 2022 is the delivery of 9,000 social homes – currently on track to be some 1,300 short according to Housing Alliance chair John Hannigan – “the bulk of which will be newly built”. 2021 saw the delivery of a total of 9,183 new social homes through new builds, acquisitions, and leasing programmes, which led to a reduction in the number of households on local authority waiting lists for the fifth consecutive year, with the overall number now 35 per cent lower than 2016 levels.

All 31 local authorities have submitted their housing delivery action plans to the Minister for Housing, Local Government and Heritage, covering the period 2022-2026. The plans contain within them information on land holdings and land required to meet social housing demand in the local authority areas.

Affordable housing will be delivered through two approaches under Housing for All: 36,000 homes under affordable purchase and 18,000 under cost rental. Applications have opened for homes under the Local Authority Affordable Purchase Scheme, with 16 three-bedroom homes in Kilcarbery Grange in south Dublin priced from €245,600; Cork City Council will soon make Boherboy homes available from €218,000. Fingal County Council will also make affordable purchase homes available this year, with two-bedroom apartments beginning at €166,000. A national First Home Shared Equity Scheme, launched in Q2 2022, is aimed at supporting first-time buyers, helping an estimated 8,000 households in the period to 2026.

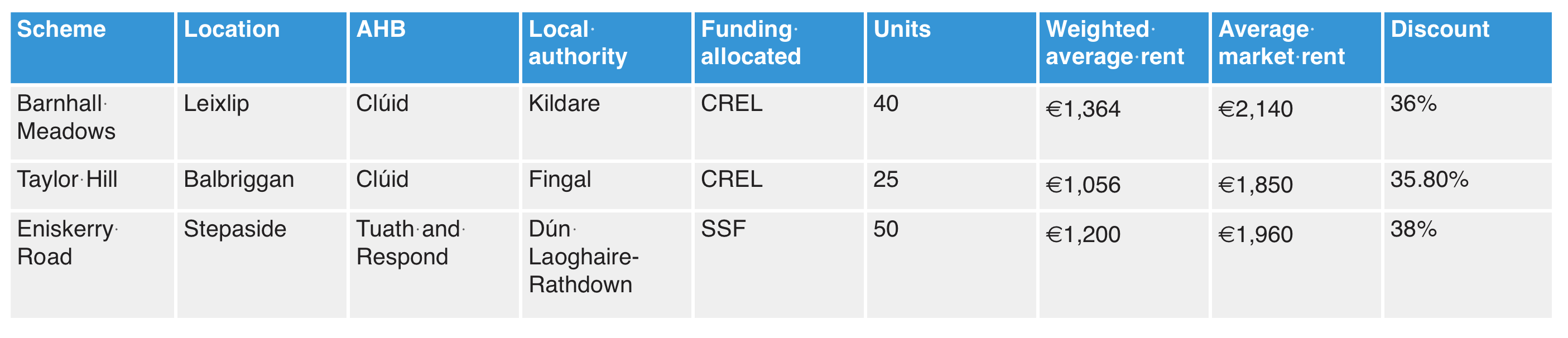

The rollout of the cost rental model, targeted at households with less than €53,000 net income, has also commenced, with funding support having delivered almost 900 cost rental homes as of the publication of the progress report; 65 of these were completed in 2021 through the Cost Rental Equity Loan (CREL) scheme, which covers up to 30 per cent of capital costs in each development.

The first cost rental homes were delivered in Balbriggan in August 2021, followed by 40 in Leixlip in October of the same year. Q1 2022 saw the delivery of 50 purpose-built cost rental homes on the Eniskerry Road in Dún Laoghaire-Rathdown. Tenants have been selected for 44 cost rental homes in Dublin’s Citywest, and projections for Q2 show the expected delivery of 147 cost rental homes in Clondalkin, Leixlip, Newcastle (County Dublin), and Newbridge.

Delivery upon the targets in all sectors will be largely dependent on the construction sector, which is currently constrained by material price inflation and capacity. The residential construction sector did show a 2.8 per cent quarterly production increase in Q1 2022, providing some cause for optimism, although the level of residential production is still 28.1 per cent below the pre-Covid level of Q1 2020, meaning that substantial levels of production increases will be needed in order for targets to be met.