The challenge of housing obsolescence

19th July 2017

Threshold: Tenancy protection

19th July 2017Irish homeowners continue to reduce mortgage debt levels

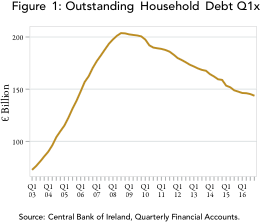

The most recent Household Credit Market Report from the Central Bank of Ireland finds that Irish households continued to reduce their debt-to-income and debt-to-asset ratios during 2016. However, in relative terms, indebtedness remains high in a European context.

The Central Bank also found that the pace of decline in overall mortgage credit continued to slow in March 2017, while growth in consumer credit remained positive.

The number of homes in mortgage arrears for more than 90 days fell to a five-year low of 7.4 per cent in the fourth quarter of 2016. This was down from 7.6 per cent in the previous three months.

The Central Bank figures also confirm that the number of buy-to-let mortgages in arrears fell to 15.7 per cent at the end of December, from 16.2 per cent at the end of September.

The number of home mortgage accounts in arrears fell for the 14th quarter in a row in the last three months of 2016 to stand at a total of 77,493, or 11 per cent of all mortgage accounts.

Meanwhile, the number of home accounts in arrears over 720 days also fell by 1,104 (3.2 per cent) during the three month period. This was the sixth quarterly decline in a row and the biggest decrease to date.

The figures show that the number of mortgages for principal dwelling houses that were classified as restructured at the end of December 2016 stood at 120,944, down 196 on the third quarter’s total.

Of these restructured accounts, 87 per cent were deemed to be meeting the terms of their current restructure arrangement, down slightly from the previous three month period.

In Q1 2017, the average standard variable rate (SVR) or LTV (Loan-to-Value) variable interest rate on Primary Dwelling House (PDH) mortgages in Ireland stood at 3.75 per cent on outstanding loans, a fall from 3.94 per cent in Q1 2016. The equivalent rate on new lending stood at 3.38 per cent in Q1 2017 compared to 3.63 per cent in Q1 2016. Fixed mortgage rates on new and outstanding lending have also fallen over this period.

For First Time Buyers (FTBs), 52 per cent of new lending was agreed at fixed rates between July and December 2016, of which 39.6 per cent were fixed for over one year maturity. Variable rates were more common among Second and Subsequent Borrowers (SSBs) and Buy-to-Lets (BTLs), at 53 and 91 per cent of new lending respectively.

During the period from July to December 2016, the average loan-to-value ratio on new lending for FTBs was 79 per cent and the average loan-to-income ratio was 2.9. The corresponding figures for SSBs were 66.3 per cent and 2.4 respectively. These ratios were largely unchanged compared to the first half of 2016.

The overall value of mortgages in arrears continues on a downward trend, falling to €16.6 billion in Q4 2016. This represents approximately 13.4 per cent of total mortgage balances. The arrears rate on non-mortgage loans is also on a declining trend.

According to Fianna Fáil Finance spokesman Michael McGrath, thousands of mortgage customers continue to be denied the correct tracker rate to which they are contractually entitled.

Specifically, he has highlighted the fact that the Central Bank has still not provided the commercial banks with a firm deadline to restore the affected customers on their correct rate.

“While the Central Bank’s industry-wide Tracker probe has been up and running since 2015, many customers who are legally entitled to be on a tracker rate of interest continue to be charged multiples of that rate by their bank,” he says.

“Other customers have been reinstated to an artificial tracker rate of between 3 per cent and 4 per cent.

“A family with a mortgage of €200,000, which is wrongly paying a variable rate of around 4 per cent and should be paying a tracker rate of 1 per cent, is paying about €500 every single month in interest more than it should be paying.

“Many of these customers have been paying this every single month, every year, for many years. This is the human reality behind this issue. This is an enormous issue in the budgets of many thousands of households across Ireland today.

He adds: “The Central Bank says that banks are required to reinstate customers on to the correct rate as soon as they have been identified. However, my experience from dealing with affected mortgage holders tells an entirely different story.

“This pace of progress and lack of urgency is simply not acceptable. The number one priority for the Central Bank has to be to ensure that customers who are being wrongly denied a tracker rate, or who are being charged the wrong tracker rate, are put on the correct rate without any further delay.”

Meanwhile, the European Investment Bank (EIB) has confirmed support for record new investment in social housing totalling €405 million that will construct and improve thousands of properties across Ireland. It is expected that 1,400 new homes will be built and more than 700 properties upgraded in Dublin and across the country under the new initiative jointly financed with the Housing Finance Agency.

Commenting on this development former Housing Minister Simon Coveney said: “I welcome the announcement of this record investment package by the European Investment Bank in social housing in Ireland, which I have been able to facilitate as Minister. Over 1,400 families will have a new home as a result.

“A further 700 householders will see their properties upgraded. The financial package will provide additional employment and support local construction suppliers. We are seeing a vital economic and social investment of €405 million.

“This initiative represents a significant combined effort from a number of critical partners in addressing what is the biggest social policy challenge we are currently facing as a country. It brings together the European Investment Bank, the Housing Finance Agency, Approved Housing Bodies, local authorities and the construction sector.

“In these times of almost unprecedented demand for housing, this new funding mechanism shows a flexibility and imagination in delivering new and improved social housing.”

He adds: “It has become a prevailing narrative in some public discourse in recent times to question our European institutions. The European Investment Bank is owned by the Member States of the European Union, including Ireland. This investment package provides a clear demonstration of the relevance and adaptability of our European institutions in meeting the specific challenges that Ireland is currently facing to increase social housing supply.”

The EIB has also confirmed expected future lending for social housing investment under a dedicated PPP financing structure to be announced in the coming months. This will enable international investors to back construction of social housing in the country for the first time.

The new €405 million initiative announced follows a €300 million social housing lending programme, agreed between the European Investment Bank and the Housing Finance Agency in December 2014.